To My Fellow Shareholders,

As I write this letter, Amgen is approaching a significant milestone: our 40th anniversary. The date was April 8, 1980, when our founders established Applied Molecular Genetics (later shortened to Amgen) in Thousand Oaks, California, to explore new business opportunities made possible by the biotechnology revolution getting underway at that time.

Since then, we’ve seen hundreds of biotech companies come and go as Amgen flourished. While Thousand Oaks still serves as our global headquarters—and our original building still stands—Amgen ranks today among the largest companies on the Fortune 500, with more than 23,000 employees in 100 countries around the world.

We are proud of what we have accomplished—and eager to do more. We know that an aging global population will require innovative new treatments for illnesses like cancer and heart disease that claim millions of lives and cost society hundreds of billions of dollars each year. The pioneering spirit of Amgen—a hallmark for four decades—gives us confidence that we can play an increasingly important role in the global healthcare ecosystem. By doing so, we are also confident that we can continue to deliver on the commitments that we make to you, our shareholders.

DELIVERING RESULTS

As anticipated, total revenues decreased slightly in 2019 as double-digit, volume-driven growth of many of our newer medicines did not fully offset the decline in sales of our off-patent legacy products, which faced increased competition around the world. Total revenues of $23.4 billion were down 2% from the prior year, with non-GAAP earnings per share rising 3% to a record $14.82.1 For the full year, Amgen achieved a non-GAAP operating margin of 50.2%,1 among the highest in our industry, which reflected our ability to manage our efficiency and ongoing productivity gains. We invested more than $4.0 billion1 in research and development, up 10% from the prior year, as we advanced numerous potential new medicines across all stages of our pipeline.

- %

- %

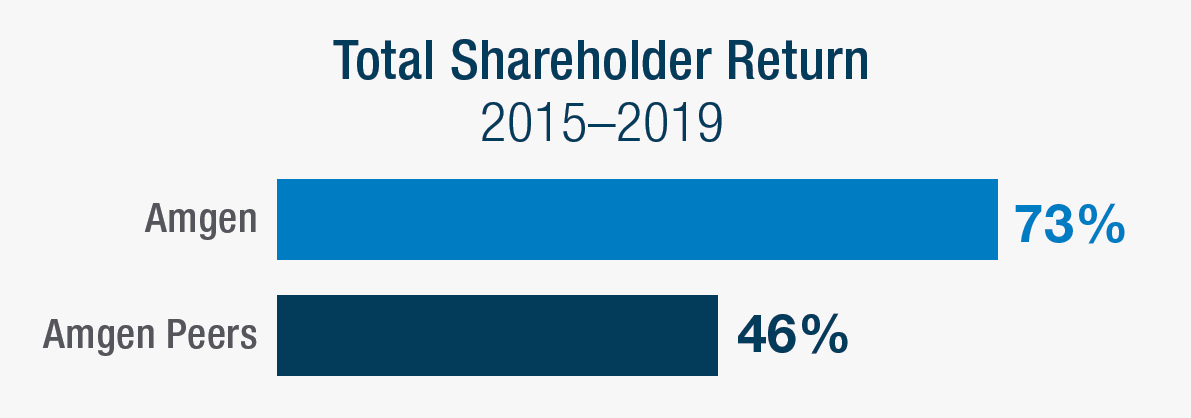

We also delivered an attractive return to our shareholders in 2019. Specifically, Amgen delivered a total shareholder return of 28% last year, exceeding the 19% average return of our peer group. Our five-year total shareholder return of 73% also outpaced the average return of our peer group, which delivered a 46% return over the same time period. Looking at an even longer investment horizon, a purchase of $10,000 of Amgen stock the day the company went public in 1983 would have been worth more than $8.6 million as of December 31, 2019, including the reinvestment of dividends. Additionally, in 2019, we returned more than $11 billion to shareholders in the form of dividends and share repurchases.

Earnings Per Share1

Operating Margin1

Amgen's Response to COVID-19

As a leading global healthcare company and responsible corporate citizen, Amgen is committed to help address the COVID-19 outbreak. We have prioritized the safety of our employees, the continued supply of our medicines to patients, and the health of the communities where we live and work. For current information on our response to this unprecedented situation, please visit www.amgen.com/COVID-19.

RETURNING TO GROWTH

2019 was a challenging year and one for which we were prepared. Managing the impact of patent expirations on highly successful products is one of the fundamental challenges that all large companies in our industry eventually face. I was pleased to report on an earnings call in January 2020 that we expect to return to top-line growth this year. There are a few factors driving our expected resurgence, including our recently launched products, our ongoing global expansion, our robust pipeline of potential new medicines, and our acquisition of Otezla®.

Strengthening Our Product Portfolio

We have launched a number of new medicines in recent years that treat some of the world’s most serious, prevalent, and costly diseases. We have been able to generate growth from these new products largely through volume gains, rather than price increases. This is critical in an environment in which healthcare systems around the world are wrestling with how to pay for the quality care that aging populations desire.

In 2019, for example, we launched EVENITY®, the first and only osteoporosis treatment that both increases bone formation and reduces bone loss, thereby rapidly reducing the risk of fracture. Osteoporosis is a major public health crisis affecting millions of people worldwide, especially women. The statistics are staggering. According to the World Health Organization, one in three women worldwide over the age of 50 will suffer a fracture due to osteoporosis. Each year in the U.S. alone, osteoporosis-related fractures account for 432,000 hospital admissions and 180,000 nursing home admissions—and after the first fracture, a woman is five times more likely to suffer another fracture within a year. Amgen has been engaged in the fight against osteoporosis for many years with Prolia®, our innovative, market-leading anti-resorptive therapy. EVENITY® gives us another weapon in this fight, and we are encouraged by its early performance and long-term potential.

We further strengthened our product portfolio in 2019 through the $13.4 billion acquisition of Otezla®, the only oral, non-biologic treatment for psoriasis and psoriatic arthritis. Otezla® bolsters our existing inflammation franchise, which includes Enbrel®, our largest product. Otezla® sales in 2019 totaled nearly $2 billion, with Amgen booking $178 million of these sales following the close of the acquisition in late November. We acquired the global rights to Otezla®, which is approved in more than 50 countries, including Amgen’s 10 largest markets. Through the acquisition, we also welcomed more than 800 new employees to Amgen and haven’t missed a beat for the more than 400,000 patients worldwide who have been treated with Otezla®. We expect this product to be a key growth driver for us in 2020 and beyond.

EVENITY® and Otezla® join a portfolio that includes six medicines that in 2019 each generated annual sales in excess of $500 million and grew at high-single-digit or double-digit rates. Repatha®, for example, is Amgen’s medicine for people with high LDL cholesterol who are at risk for heart attacks and strokes—devastating health events that occur every 40 seconds in the U.S. In 2018, to address access challenges, we made Repatha® available in the U.S. at 60% less than its original list price. This decision led to 20% sales growth in 2019 as more patients, especially senior citizens in the Medicare program, were able to access this important medicine at a more affordable co-pay.

In addition to new innovative medicines, we are strengthening our product portfolio by leveraging our decades of biomanufacturing experience to bring to patients a reliable supply of high-quality biosimilars, which are typically priced below the originator medicines with which they compete. In 2019, AMGEVITA™, our biosimilar to the autoimmune disease treatment Humira®, the world’s best-selling medicine, generated more than $200 million in global sales. We also launched our first two biosimilars in the U.S., MVASI™ and KANJINTI™, which are biosimilars to the cancer treatments Avastin® and Herceptin®, respectively. In total, Amgen biosimilars generated $568 million in 2019 sales and we believe these medicines represent a significant growth opportunity for us over time.

Biosimilars also benefit our business because they free up funds in healthcare budgets that can be redirected toward our innovative medicines. As the number of biosimilars in our portfolio grows, we are increasingly able to have more holistic conversations with healthcare systems about how best to care for the patients they serve—and how to pay for that care. For example, AMGEVITA™ is highly complementary to Otezla®, as both medicines treat patients with chronic inflammatory diseases. Similarly, MVASI™ and KANJINTI™ complement the many innovative cancer medicines in our portfolio. In 2020, we plan to launch AVSOLA™, our biosimilar to the inflammation treatment Remicade®, in the U.S., and we continue to advance several additional biosimilars through our pipeline, including ABP 938, our biosimilar to EYLEA® for age-related macular degeneration.

Expanding Our Geographic Presence

For much of our 40-year history, Amgen offered its medicines to patients primarily in one market: the U.S. Although the U.S. remains the world’s largest pharmaceutical market—and therefore continues to be a top priority for Amgen—the rest of the world offers increasingly compelling opportunities to serve more patients and drive growth. We are especially excited by our prospects in China and Japan, the world’s second- and third-largest pharmaceutical markets, respectively.

In 2019, we announced a strategic collaboration with BeiGene—a biotechnology company with a large presence and deep experience in China—to expand Amgen’s oncology business there and advance the development of our innovative oncology pipeline globally. In January 2020, as part of the collaboration, Amgen acquired a 20.5% ownership stake in BeiGene for approximately $2.8 billion, while BeiGene will contribute up to $1.25 billion to advance 20 medicines from Amgen’s innovative oncology pipeline. We will use data generated from clinical trials in China to support regulatory filings in that country and around the world. Additionally, BeiGene will commercialize select current and future Amgen oncology medicines in China for up to seven years, after which most of these medicines will return to Amgen.

We are committed to serving cancer patients in China, and we expect BeiGene will enable us to have an impact sooner than we could have achieved on our own. Cancer currently claims an estimated 2.3 million lives in China every year and it will only become an even more pressing public health concern as the population ages. Beyond cancer, Amgen will continue to develop and commercialize medicines in China for chronic conditions such as cardiovascular disease.

We have built our business in Japan largely through partnerships with local companies, including, most recently, Astellas Pharma. In April 2020, we will assume full ownership of the Amgen Astellas BioPharma joint venture, enabling us to do business in Japan through a wholly owned Amgen subsidiary.

Japan is a “super-aged” society, with 27% of its population 65 or older—the highest percentage in the world—and it will require ever more innovative medicines to treat diseases associated with the aging process. We’ve enjoyed great success in Japan with EVENITY®, for example, the osteoporosis treatment described above. In fact, Japan was the first market in the world where EVENITY® was launched.

We are confident that our current and emerging portfolio of medicines matches up well with the needs of patients in the Asia-Pacific region—so much so that we expect roughly 25% of our total sales growth to come from this region over the next 10 years.

Advancing Our Pipeline

Over the past five years, we have invested nearly $19 billion1 in research and development. As of this writing, more than 31,000 patients are enrolled in some 150 clinical trials around the world involving dozens of potential new Amgen medicines. In 2019 alone, we advanced seven potential new therapies into Phase 1 clinical studies, and we submitted Investigational New Drug applications to bring four additional molecules into the clinic. In keeping with our enduring commitment to cutting-edge research—two-thirds of the innovative medicines we currently market are first-in-class therapies—a large majority of our pipeline programs aim to take medicine in new directions and provide substantial new benefits to patients.

For example, AMG 510 is a potential first-in-class medicine for non-small cell lung cancer and other solid tumors that have a particular genetic mutation known as KRAS G12C. This mutation is found in approximately 13% of non-small cell lung cancers, 3%–5% of colorectal cancers, and 1%–2% of other solid tumors. Cancer researchers have known about KRAS G12C for more than 30 years, but it’s long been considered an “undruggable” target. Amgen scientists were the first to exploit a previously hidden crevice on the surface of the KRASG12C protein to engineer a molecule that has demonstrated encouraging results for patients who otherwise currently have very few treatment options. We are studying AMG 510 as a monotherapy and in combination with other cancer therapies, and we expect data from some of these studies to become available later this year.

Amgen is also a pioneer in the development of bispecific T cell engagers, or BiTE® antibody constructs, which are designed to harness a patient’s own immune system to fight cancer. Our pipeline now includes about a dozen BiTE® molecules directed against both liquid and solid tumors, including multiple myeloma, acute myeloid leukemia, and prostate cancer. We expect to report important data on several of our BiTE® molecules in 2020.

One in five cancer patients in the U.S. is already being treated with an Amgen medicine, and we are excited to continue building on our strong legacy in oncology. We also recognize that oncology is a very crowded and competitive therapeutic category—good news for patients but challenging for companies that are often pursuing the same promising targets. In response, we have worked hard in recent years to dramatically improve the speed with which we move new drug candidates forward. On average, we have taken three years out of a drug discovery and development cycle that historically has taken anywhere from 10 to 15 years. In some cases, as with AMG 510, we have been moving even faster. We also have become more agile in terms of how we allocate our resources. As new data emerges about our oncology molecules and those being developed by others, we will be clear-eyed in our analysis and quickly adjust our investment levels up or down, as appropriate.

We also have a number of promising new drug candidates outside of oncology. One of these is tezepelumab, a first-in-class investigational monoclonal antibody for severe asthma, a debilitating disease that affects an estimated 30 million people worldwide—a number that is expected to rise dramatically as more people move to large cities where air pollution is often an unfortunate fact of life. Along with our partner AstraZeneca, we expect to see data from a pivotal Phase 3 clinical trial of tezepelumab by the end of this year.

We also anticipate pivotal Phase 3 data later this year for omecamtiv mecarbil, which we are studying as a treatment for heart failure with reduced ejection fraction in collaboration with our partners Cytokinetics and Servier. An estimated 64 million people worldwide are living with heart failure, and roughly half of these patients will die within five years of being diagnosed—meaning there is an urgent need for new treatments.

To learn more about the many potential new medicines in our pipeline, please visit www.amgenpipeline.com.

Pushing the Boundaries of Science

When it comes to research and development, many of our peers have opted to focus largely on development, leaving early-stage research to smaller companies and acquiring drugs only after they have progressed into the later stages of the research and development process. Amgen is taking a very different approach. Just as the creation of recombinant DNA sparked the biotechnology revolution in the 1980s, a new revolution fueled by human genetics and related data is enhancing our understanding of human biology and, with it, our ability to predict and prevent diseases to a previously unimaginable degree. It is critical to Amgen’s long-term success that we be a part of this revolution and we believe we are in a position to lead it.

Since our acquisition of Reykjavik-based deCODE Genetics in 2012, we have invested aggressively to strengthen its research infrastructure and expand its data pipeline well beyond Iceland. When it comes to human genetics, the more data, the better—and since becoming an Amgen subsidiary, deCODE has increased the number of participants in its research tenfold. This expansion will continue to accelerate with two major research initiatives launched in 2019. In June, deCODE entered into a collaboration with Intermountain Healthcare, an integrated healthcare delivery network, to analyze the genomes of up to 500,000 Intermountain patients, located primarily in Utah and Idaho. In September, Amgen and deCODE joined the UK Biobank’s Whole Genome Sequencing project—the most ambitious effort of its kind yet undertaken. deCODE was selected as one of two providers, along with the Sanger Institute, to sequence the whole genomes of all 500,000 participants in this program.

To complement our strength in human genetics, we have broadened our focus to include other types of human data that can generate deeper insights into disease biology. For example, advances in proteomics now allow us to measure the levels of proteins that are potentially meaningful but present at previously undetectable concentrations in the blood. In collaboration with SomaLogic, a leader in proteomics technology, deCODE has measured the relative levels of about 5,000 different proteins in plasma collected from 37,000 Icelanders whose genomes have been sequenced. To our knowledge, this is the largest proteomics experiment ever conducted. By combining data on proteins, RNA, and genetics, we are beginning to generate insights that will have a profound impact on drug discovery and clinical trials. We are already using this multilayered information to design more efficient clinical trials by identifying patients who are at higher risk for poor outcomes and more likely to benefit from the therapies we are testing.

In 2019, we also acquired Nuevolution—now Amgen Research Copenhagen—a pioneer and leader in the field of DNA-encoded libraries. In a DNA-encoded library, each compound is tagged with a unique sequence of DNA that functions like a barcode, and mixtures containing billions of unique DNA-tagged compounds can be screened in a single small test tube.

The massive increase in screening power makes it practical to search for extremely rare compounds that can engage targets now considered undruggable. This technology will also advance Amgen’s effort to pioneer new types of drug molecules that work through a principle known as induced proximity. While nearly all medicines today achieve their effects by directly engaging a single target, induced proximity agents have multi-specific activity that enable them to function like “molecular matchmakers.” Instead of trying to tackle difficult drug targets on their own, these molecules can enlist powerful biological mechanisms to get the job done. While this new paradigm is just getting started, we believe it has astonishing potential to treat diseases that currently have few, if any, good treatment options.

OPERATING WITH PURPOSE

Over the course of our 40-year history, Amgen has made a difference in the health of patients around the world by discovering, developing, and bringing to market innovative medicines—and this will continue to be the best way we can contribute to the greater good. We survey thousands of our employees each quarter. Consistently, they are passionate about our mission and values, committed to ethical behavior, and understand how their work individually contributes to Amgen’s collective success.

Our people also believe strongly that they work in an environment in which diverse backgrounds and perspectives are welcomed and valued. We have nine employee resource groups at Amgen encompassing thousands of employees worldwide who are dedicated to supporting each other, our business, and the community. These groups represent African Americans, women, veterans, the LGBTQ community, those with disabilities, and early career professionals, among others—and each group is sponsored by one of my direct reports. To give you just one example of the impact our employee resource groups are having, the Amgen Black Employees Network collaborated with our Oncology team in 2019 to create an award-winning educational website about multiple myeloma focused on African Americans, who have more than double the risk of developing this disease than the general population.

Increasingly, our employees want to work for a company with a purpose that goes beyond “the numbers.” We are fortunate at Amgen to have a core business that is centered on improving human health—a noble purpose to be sure, but we can do more. We know, for example, that too many patients who need medicines struggle to access them. We are committed to responsible pricing practices and, in fact, the net selling price of our medicines declined in 2018 and 2019 globally, as we expect it will again this year. Additionally, in 2019, the Amgen Safety Net Foundation provided nearly $1.5 billion of our medicines to uninsured or underinsured patients in the U.S. at no cost—and nearly $7 billion of our medicines since 2008. We also are working closely with elected officials, insurers, patient groups, and others to advocate for changes in the U.S. healthcare system that will make prescription medicines more accessible and affordable. Outside the U.S., we recently completed our second donation of biologic medicines to low- and middle-income countries around the world through the humanitarian aid organization Direct Relief.

We operate our business in a way that seeks to minimize our impact on the environment. In 2019, Amgen achieved—one year ahead of schedule—targets we set seven years earlier to reduce our carbon emissions and water use, even as our business has significantly expanded during this time period. Later this year, we will establish a new set of environmental targets, which you will be able to see at www.amgen.com/responsibility.

We continue to work on the construction of our second next-generation biomanufacturing facility, located in Rhode Island. This new plant builds on the success of our first such facility in Singapore, which delivers the same output as a traditional manufacturing facility but in a much smaller physical space. Compared with a traditional plant, our Singapore facility each year uses approximately 268,000 less gigajoules of energy and 82,000 fewer cubic meters of water, while also reducing carbon emissions by 8,800 metric tons.

Just as we are working to ensure the sustainability of the planet, we are also passionate about ensuring the sustainability of scientific progress. Amgen is in a long-cycle business. A new treatment discovered in our laboratories today might be launched a dozen years from now by future Amgen employees who are still in high school. Toward that end, the Amgen Foundation is focused on inspiring the next generation of innovators by bringing top-notch science education to millions of young people around the world—seven million and counting, in fact.

For example, the Amgen Foundation is the exclusive sponsor of the biology lessons offered by Khan Academy, which provides free, world-class educational content online. Since our partnership began in 2015, the number of people accessing Khan Academy’s biology lessons has increased eightfold to well over 3 million per month.

Earlier this year, the Amgen Foundation announced a partnership with the Harvard Faculty of Arts and Sciences to launch LabXchange, a virtual learning laboratory that, like the lessons offered by Khan Academy, is available at no cost to anyone worldwide. LabXchange provides the opportunity to practice scientific experiments using interactive simulations of the same cutting-edge equipment found in modern biotech laboratories—from pipettes and high-powered microscopes to centrifuges and spectrophotometers. We believe LabXchange will be especially valuable to those students in schools or countries where teachers lack the resources to provide engaging, hands-on scientific experiences.

The Amgen Foundation also continues to expand its in-classroom programs, including the Amgen Biotech Experience, a two-week, lab-based program that enables high school students to build a better understanding of science and how it applies to making medicines. This program began 30 years ago when a few Amgen scientists in Thousand Oaks, California, partnered with a local biology teacher to engage students at nearby high schools. Since then, more than 800,000 students in 11 countries around the world have participated in the program—and we are delighted that some of them now work at Amgen.

WORKING TOWARD A HEALTHIER FUTURE

As I reflect on the past 40 years at Amgen and consider the next 40, I am struck both by the incredible medical progress that’s been made over time and by how much hard work is still left to be done. Cancer is a good example.

At our founding in 1980, the death rate for cancer in the U.S. was on the rise and wouldn’t reach its peak until 1991. Since then, according to the American Cancer Society, the cancer death rate has been steadily declining, falling 27% in aggregate over the past 25 years. Fully half of this remarkable decline is attributed to the growing number of innovative cancer medicines that have become available to patients. Can all of us at Amgen be proud of the contributions we’ve made to dramatically improving cancer care? Absolutely. Is it time to declare mission accomplished? Absolutely not. Not when cancer will claim over 600,000 lives in the U.S. this year—and nearly 9 million more lives around the world. Not when the five-year survival rate for many common cancers remains below 50%. Not when new cancer medicines are seen as significant advances when they extend life for a few months, rather than for several years. Not when cancer costs the world more than $1 trillion every year.

We enter our fifth decade at Amgen more confident than ever in our ability to make a difference against cancer and many other of the world’s most serious illnesses. By doing so, we will not only change the lives of tens of millions of patients but also create more opportunities for our employees, strengthen the communities where we live and work, and create long-term shareholder value.

On behalf of Amgen’s board of directors, our senior leadership team, and our employees around the world, I thank you for your continued support of our company and the important work we do.

Robert A. Bradway

Chairman and Chief Executive Officer

March 18, 2020

- This is a non-GAAP financial measure. See reconciliation to U.S. generally accepted accounting principles (GAAP) accompanying this letter

Reconciliations of GAAP to Non-GAAP Measures (Unaudited)

(In millions, except per-share data)

| Years ended December 31, | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|

| GAAP research and development expenses | $4,116 | $3,737 | $3,562 | $3,840 | $4,070 | $4,297 |

| Adjustments to research and development expenses: | ||||||

| Acquisition-related expenses(a) | (87) | (78) | (77) | (78) | (89) | (124) |

| Certain net charges pursuant to our restructuring initiative(b) | (2) | (2) | (3) | (7) | (64) | (49) |

| Other | — | — | — | — | — | (3) |

| Total adjustments to research and development expenses | (89) | (80) | (80) | (85) | (153) | (176) |

| Non-GAAP research and development expenses | $4,027 | $3,657 | $3,482 | $3,755 | $3,917 | $4,121 |

| GAAP operating income | $9,674 | $10,263 | $9,973 | $9,794 | $8,470 | $6,191 |

| Adjustments to operating income: | ||||||

| Acquisition-related expenses(a) | 1,438 | 1,557 | 1,594 | 1,510 | 1,377 | 1,546 |

| Certain net charges pursuant to our restructuring and other cost savings initiatives(b) | 45 | 12 | 88 | 37 | 114 | 596 |

| Expense (benefit) related to various legal proceedings | — | — | — | 105 | 91 | (3) |

| Expense resulting from clarified guidance on branded prescription drug fee(c) | — | — | — | — | — | 129 |

| Other | — | 25 | 3 | — | — | 16 |

| Total adjustments to operating income | 1,483 | 1,594 | 1,685 | 1,652 | 1,582 | 2,284 |

| Non-GAAP operating income | $11,157 | $11,857 | $11,658 | $11,446 | $10,052 | $8,475 |

| GAAP operating income as a percentage of product sales | 43.6% | 45.5% | 45.8% | 44.7% | 40.4% | 32.0% |

| Adjustments to operating income | 6.6 | 7.1 | 7.7 | 7.6 | 7.6 | 11.9 |

| Non-GAAP operating income as a percentage of product sales | 50.2% | 52.6% | 53.5% | 52.3% | 48.0% | 43.9% |

| GAAP net income | $7,842 | $8,394 | $1,979 | $7,722 | $6,939 | $5,158 |

| Adjustments to net income: | ||||||

| Adjustments to operating expenses | 1,483 | 1,594 | 1,685 | 1,652 | 1,582 | 2,284 |

| Adjustments to other income(d) | — | (68) | — | — | — | — |

| Income tax effect of the above adjustments(e) | (329) | (362) | (538) | (525) | (496) | (717) |

| Other income tax adjustments(f) | 32 | 15 | 6,120 | (64) | (71) | (25) |

| Total adjustments to net income | 1,186 | 1,179 | 7,267 | 1,063 | 1,015 | 1,542 |

| Non-GAAP net income | $9,028 | $9,573 | $9,246 | $8,785 | $7,954 | $6,700 |

| Weighted-average shares for GAAP diluted EPS | 609 | 665 | 735 | 754 | 766 | 770 |

| Weighted-average shares for Non-GAAP diluted EPS | 609 | 665 | 735 | 754 | 766 | 770 |

| GAAP diluted EPS | $12.88 | $12.62 | $2.69 | $10.24 | $9.06 | $6.70 |

| Non-GAAP diluted EPS | $14.82 | $14.40 | $12.58 | $11.65 | $10.38 | $8.70 |

- The adjustments related primarily to noncash amortization of intangible assets acquired in business combinations. For the years ended December 31, 2018 and 2017, the adjustments to operating income also included impairments of intangible assets acquired in business combinations.

- The adjustments related to headcount charges, such as severance, and to asset charges, such as asset impairments, accelerated depreciation and other charges related to the closure of our facilities.

- The adjustment related to the recognition of an additional year of the nontax deductible branded prescription drug fee, as required by final regulations issued by the Internal Revenue Service.

- For the year ended December 31, 2018, the adjustment related to the net gain associated with the Kirin-Amgen share acquisition.

- The tax effect of the adjustments between our GAAP and non-GAAP results takes into account the tax treatment and related tax rate(s) that apply to each adjustment in the applicable tax jurisdiction(s). Generally, this results in a tax impact at the U.S. marginal tax rate for certain adjustments, including the majority of amortization of intangible assets, whereas the tax impact of other adjustments, including restructuring expense, depends on whether the amounts are deductible in the respective tax jurisdictions and the applicable tax rate(s) in those jurisdictions.

- The adjustments related to certain acquisition items and prior-period items excluded from GAAP earnings. For the year ended December 31, 2017, the adjustment related primarily to the impact of U.S. Corporate tax reform, including the repatriation tax on accumulated foreign earnings and the remeasurement of certain net deferred and other tax liabilities.

Reconciliations of Cash Flows (Unaudited)

(In millions)

| Year ended December 31, | 2019 |

|---|---|

| Net cash provided by operating activities | $9,150 |

| Net cash provided by investing activities | 5,709 |

| Net cash used in financing activities | (15,767) |

| Decrease in cash and cash equivalents | (908) |

| Cash and cash equivalents at beginning of year | 6,945 |

| Cash and cash equivalents at end of year | $6,037 |

| Net cash provided by operating activities | $9,150 |

| Capital expenditures | (618) |

| Free cash flow | $8,532 |

Reconciliation of GAAP to Non-GAAP Financial Measures

The non-GAAP financial measures are derived by excluding certain amounts, expenses or income, from the corresponding financial measures determined in accordance with GAAP. The determination of the amounts that are excluded from these non-GAAP financial measures is a matter of management judgment and depend upon, among other factors, the nature of the underlying expense or income amounts recognized in a given period. Historically, management has excluded the following items from these non-GAAP financial measures, and such items may also be excluded in future periods and could be significant:

- Expenses related to the acquisition of businesses, including amortization and/or impairment of acquired intangible assets, including in-process research and development, adjustments to contingent consideration, integration costs, severance and retention costs and transaction costs;

- Charges associated with restructuring or cost saving initiatives, including but not limited to asset impairments, accelerated depreciation, severance costs and lease abandonment charges;

- Legal settlements or awards;

- The tax effect of the above items;

- Non-routine settlements with tax authorities; and

- The impact of the adoption of the U.S. Corporate tax reform.

Forward-Looking Statements: This communication contains forward-looking statements that are based on the current expectations and beliefs of Amgen. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements, including any statements on the outcome, benefits and synergies of collaborations with any other company, including BeiGene, Ltd., or the Otezla® (apremilast) acquisition, including anticipated Otezla sales growth and the timing of non-GAAP EPS accretion, as well as estimates of revenues, operating margins, capital expenditures, cash, other financial metrics, expected legal, arbitration, political, regulatory or clinical results or practices, customer and prescriber patterns or practices, reimbursement activities and outcomes, effects of pandemics or other widespread health problems such as the ongoing COVID-19 pandemic on our business, and other such estimates and results. Forward-looking statements involve significant risks and uncertainties, including those discussed below and more fully described in the Securities and Exchange Commission reports filed by Amgen, including our most recent annual report on Form 10-K and any subsequent periodic reports on Form 10-Q and current reports on Form 8-K. Unless otherwise noted, Amgen is providing this information as of the date of this letter to shareholders and does not undertake any obligation to update any forward-looking statements contained in this document as a result of new information, future events or otherwise.

No forward-looking statement can be guaranteed and actual results may differ materially from those we project. Our results may be affected by our ability to successfully market both new and existing products domestically and internationally, clinical and regulatory developments involving current and future products, sales growth of recently launched products, competition from other products including biosimilars, difficulties or delays in manufacturing our products and global economic conditions. In addition, sales of our products are affected by pricing pressure, political and public scrutiny and reimbursement policies imposed by third-party payers, including governments, private insurance plans and managed care providers and may be affected by regulatory, clinical and guideline developments and domestic and international trends toward managed care and healthcare cost containment. Furthermore, our research, testing, pricing, marketing and other operations are subject to extensive regulation by domestic and foreign government regulatory authorities. We or others could identify safety, side effects or manufacturing problems with our products, including our devices, after they are on the market. Our business may be impacted by government investigations, litigation and product liability claims. In addition, our business may be impacted by the adoption of new tax legislation or exposure to additional tax liabilities. If we fail to meet the compliance obligations in the corporate integrity agreement between us and the U.S. government, we could become subject to significant sanctions. Further, while we routinely obtain patents for our products and technology, the protection offered by our patents and patent applications may be challenged, invalidated or circumvented by our competitors, or we may fail to prevail in present and future intellectual property litigation. We perform a substantial amount of our commercial manufacturing activities at a few key facilities, including in Puerto Rico, and also depend on third parties for a portion of our manufacturing activities, and limits on supply may constrain sales of certain of our current products and product candidate development. An outbreak of disease or similar public health threat, such as COVID-19, and the public and governmental effort to mitigate against the spread of such disease, could have a significant adverse effect on the supply of materials for our manufacturing activities, the distribution of our products, the commercialization of our product candidates, and our clinical trial operations, and any such events may have a material adverse effect on our product sales, business and results of operations. We rely on collaborations with third parties for the development of some of our product candidates and for the commercialization and sales of some of our commercial products. In addition, we compete with other companies with respect to many of our marketed products as well as for the discovery and development of new products. Discovery or identification of new product candidates or development of new indications for existing products cannot be guaranteed and movement from concept to product is uncertain; consequently, there can be no guarantee that any particular product candidate or development of a new indication for an existing product will be successful and become a commercial product. Further, some raw materials, medical devices and component parts for our products are supplied by sole third-party suppliers. Certain of our distributors, customers and payers have substantial purchasing leverage in their dealings with us. The discovery of significant problems with a product similar to one of our products that implicate an entire class of products could have a material adverse effect on sales of the affected products and on our business and results of operations. Our efforts to collaborate with or acquire other companies, products or technology, and to integrate the operations of companies or to support the products or technology we have acquired, may not be successful. A breakdown, cyberattack or information security breach could compromise the confidentiality, integrity and availability of our systems and our data. Our stock price is volatile and may be affected by a number of events. Our business performance could affect or limit the ability of our Board of Directors to declare a dividend or our ability to pay a dividend or repurchase our common stock. We may not be able to access the capital and credit markets on terms that are favorable to us, or at all.